Cares Act Illinois Student Loans

First, let’s talk about what the cares act does for student loan borrowers and who it helps. But thanks to the federal coronavirus aid, relief and economic security (cares) act, you might qualify to temporarily pay nothing at all.

Student Financial Aid And Debt Management Medicine

Under cares act •the cares act allows for the following relief to federal student borrowers:

Cares act illinois student loans. Ffel loans held by commercial lenders The coronavirus aid, relief, and economic security act or, cares act, was passed by congress on march 27th, 2020. Pritzker said the state has secured relief options for student loan borrowers who weren’t previously covered by the federal cares act, which provides relief to those with federal loans, but.

The automatic suspension does not apply to any other student loans, including: Nearly $13 billion for higher education emergency relief for students and institutions (april 21, 2020) Of that money, approximately $14 billion was given to the office of postsecondary education as.

Kristen thometz | april 21, 2020 4:57 pm. Covers approximately 95% of borrowers, excludes federal debt held by private companies (federal family education loan program) and federal debt held by colleges and universities. The cares act provides assistance to most federal student loan borrowers, and if you have this type of debt, here’s what the new law can do for you.

Federal income taxes on the payments. In the meantime, isac and the state of illinois have worked to mitigate hardships for student borrowers with other federal loans not covered by the cares act. That could make a significant dent in a borrower’s total debt load, which averaged nearly $30,000 for the class of 2018.

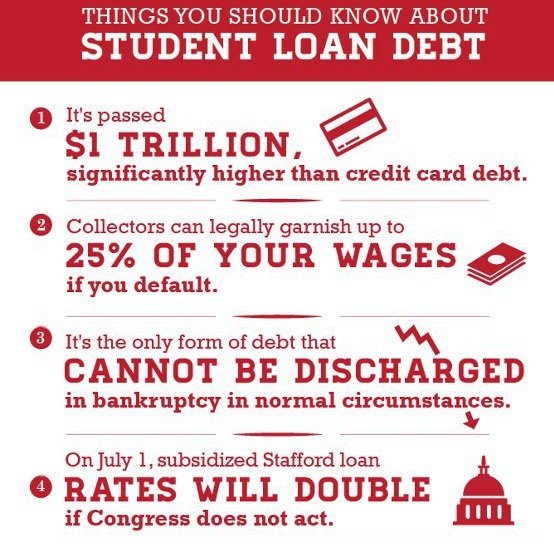

Defaulted student loan borrowers have new rehabilitation options under the cares act. The coronavirus aid, relief, and economic security act “cares act” (passed by congress on march 27, 2020) provides garnishment relief to some federal student loan borrowers until september 30, 2020. For most borrowers, all federal student loan payments, and accrual of interest, has been waived until september 30, 2020.

Meaning, if you have these federal student loans you do not have to worry about making. However, the cares act left out millions of student loan borrowers with federal loans that are not owned by the us government as well as loans made by private lenders. The us department of education (ed) in implementing the president’s executive order of august 21, 2020, has clarified the rehabilitation benefits for former student borrowers who have defaulted on a federal student loan.

The cares act provides pandemic relief for employers to help repay employee student loans through an amendment to section 127 of the irs code, extended through december 31, 2025. If you have federally held student loans, which include stafford subsidized loans for your children or parent plus loans for you, student loan interest and payments are paused until september 30, 2020. Information on governor's emergency education relief (geer) fund authorized by the cares act (april 14, 2020) the us department of education's website for the education stabilization fund (april 13, 2020) cares act information:

Suspension of student loan debt collection Department of education between march 13, 2020 and jan. The cares act expanded the scope of educational assistance programs under section 127 of the code to include student loan repayments.

Student loans and wage garnishments under the cares act. Under the new law, no payments are required on federal student loans owned by the u.s. The cares act and employer student loan contributions.

Employers who pay student loans as an employee benefit may contribute up to $5,250 tax free for 2020. Illinois residents who are struggling to make student loan payments could soon get some relief. Pritzker said, this newly approved.

The cares act, the sweeping stimulus legislation enacted in march, includes relief for student loan borrowers. By kate vivian davis, jason r. Under prior law, that provision only allowed for an exclusion from an employee's income for educational assistance that was provided by an employer prospectively.

The cares act provided relief for small businesses and laid off workers. The cares act has temporarily broadened those educational expenses to include qualified student loans. For the tax year 2020, employees may exclude from their gross income up to $5,250 for employer payments made toward their student loans.

Essentially, ed has extended the cares act benefits through december 31 st. Following the enactment of president trump’s executive order on august 21, 2020, the united states department of education has outlined the rehabilitation benefits for those who had previously defaulted on student loans issued by the federal government. The cares act allows employers to pay up to $5,250 toward student loans on behalf of employees and the employees would not owe u.s.

If you hold federal student loans that are not already eligible for all the benefits available under the cares act, you do have the option to consolidate loans that are not covered by the act into a federal direct loan. Employers can pay down their workers’ student loans by more than $5,000 this year, tax free, under a provision in the cares act. The average student loan payment is $393 per month.

The cares act temporarily suspends payments on the following student loans that are owned by the department of education (ed):

Faq Student Financial Aid And Scholarships University Of Illinois Chicago

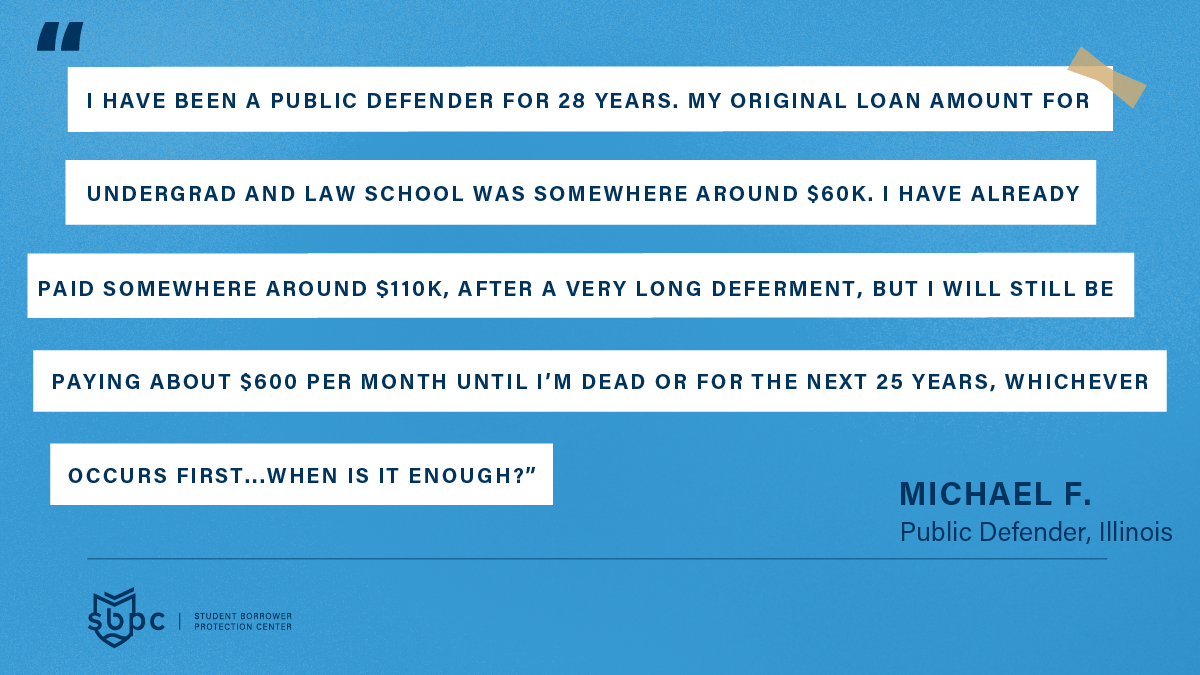

Tell The Department Of Education To Fix Public Service Loan Forgiveness And Deliver On The Promise Of Debt Relief For The Legal Services Community - Student Loan Borrowers Assistance

6 Best Student Loans Of 2021 Money

How To Get A Student Loan Money

The Cares Act And Student Loans A Guide I Morgan Stanley At Work

House Introduces Heroes Act With Student Loan Forgiveness

Coronavirus And Student Loans What Borrowers Should Know

Illinois Program Is Paying Off Student Loans To Help People Buy Houses

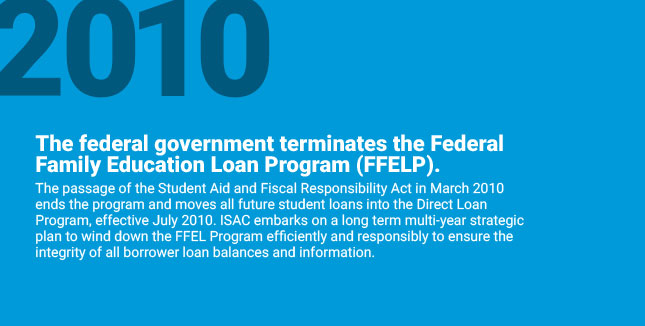

College Information And Guidance About Isac Illinois Student Assistance Commission

College Information And Guidance About Isac Illinois Student Assistance Commission

Student Loan Forgiveness Programs Credible

Coronavirus Emergency Financial Aid - Where To Get Covid-19 Related Cares Act Federal Student Loans Other Funds

Student Loans And The Pandemic Your Questions Answered Death Sex Money Wnyc Studios

/Earnest_Recirc-f4051537c54f45b6b218555605f31585.jpg)

Earnest Student Loans Review 2021

Student Loan Debt Relief Programmade Easyas Covid-19 Relief Ends

Student Loan Forgiveness For Frontline Health Workers Act 2020 116th Congress Hr 6720 - Govtrackus

Statute Of Limitations On Private Student Loans State Guide - Credible

Illinois Student Loan Forgiveness Programs

/GettyImages-469187462-567c718d5f9b586a9e9dafaf-5c112b82c9e77c00012cb9bd.jpg)

How To Get Covid-19 Student Loan Relief